Dr. Hurd: I liked your column the other day about how Americans feel entitled to middle-class welfare benefits such as Medicare. But I think you miss one point. I AM entitled!

You see, the government has been taking money from me for 25 years and telling me I will:

Get unemployment if I need it;

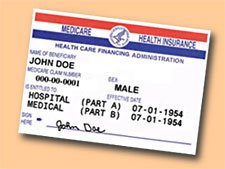

Have social security and health care when I retire;

And get food stamps if I must eat.

I am entitled to these. They took my money and in exchange told me I am getting a service.

Personally, I don’t want their service. I want my money and for them to stop taking it, but they have taken it and they do owe me!

I wonder if I can try and get some food stamps while working a full time job….hmmmm at least try and get something for my money.

Dr. Hurd replies: Nobody can argue with what you’re saying. But remember:

Government says you’re entitled to these things to be paid for BY the people who pay taxes at the time you receive the benefits.

The Medicare and Social Security “trust funds” are nothing more than myths, given the by now utter bankruptcy not just of these programs, but of the entire American government. People getting paid Medicare and Social Security today are provided those benefits by those currently working. Actually, one correction: By those working many decades or even centuries from now, since all things government-related are financed by trillions of dollars of government debt. Theoretical “money” pays for welfare state benefits, not actual money.

In a normal purchase, you choose to buy something with money you have already earned. Or, you choose to buy something with money you buy from a third party — a bank or lending institution — who loans you the money (1) with full consent of what you’re using it for; and (2) with written agreement as to when you’ll pay it back.

None of this is operative in the “exchange” between government and citizen. Under government programs, the more money you make, the more you pay in taxes. The longer you work, and the less disruption in your work over the span of your career, the less you will receive from the government and the more you will pay into a system for those unable/unwilling to work. If you go through your whole life never receiving food stamps, you’ll pay more into that system of food stamps than somebody who draws those benefits for part, or even all, of his adult life.

Medicare and Social Security are a little different. It’s true that you are promised those benefits no matter what, once reaching a certain age. That promise is considered as absolute as the requirement to pay for those programs, for others, while you’re still young or middle-aged and working. Medicare and Social Security are not, strictly speaking, wealth transfers, other than the extent to which some people start drawing them early (due to applying for disability). Of course, for those unfortunate enough to turn retirement age when — not if, but when — those programs go completely bankrupt, Medicare and Social Security will have, to them, represented huge wealth transfers. They will have spent their whole adult lives paying payroll/FICA taxes for benefits enjoyed by others, but that they will never receive themselves.

Unemployment insurance is absolutely a wealth transfer, from those who pay taxes and will never use those benefits, to those who, at least for part of their careers, cannot or will not work, and do receive those benefits. This didn’t used to matter quite so much as it does now. Government tends to renew and expand unemployment benefits during periods of recession and economic downturn. The latest economic numbers show that the real estate and jobs markets are still in a major recession, for going on five years now. If this recession becomes long-term bordering on permanent, so too will the unemployment benefits transferred to those not working from those who still are.

And none of this involves choice, not on anybody’s part. These programs exist not in a private marketplace, where people choose to purchase unemployment, health and retirement insurance just as they might voluntarily choose to purchase flood, fire or travel insurance. These programs are entitlements. They’re available whether you pay for them or not, and those who work are forced to pay for them, whether they want the coverage or not.

I know what you’re saying. You’re saying, “I paid for all this, and I pay for it every day of my working life. So I’m owed it, if I want it and need it.” True enough. This justifies you claiming the benefits for which you paid, but it’s no guarantee the government will be able to provide them — not if our system of currency financed by debt collapses in unforeseen ways, and not if our economy continues to fail to grow, or even falters further in the years to come due to Obama’s anti-private sector policies.

However, your claim does not justify the existence of the system in the first place. Government never had the right, to begin with, to initiate force against its citizens and require them to take part in a government-run insurance system. Particularly a set of programs that have become THE primary expense and function of the federal government, programs neither required nor permitted by the Constitution.

Yes, in a moral sense you are justified in getting back any money you were forced to pay into that system. But you and I both know that you’re unlikely to ever see it, not if you continue working, and not if you’re retiring 20 years down the pike at which time Social Security and Medicare (as we know them) will surely be long gone.

It’s kind of like getting back stolen property from thieves. Except with thieves, you at least have a chance of getting your property back, assuming the government is just about prosecuting thieves.

When government itself becomes the thief, who’s on your side then?